In 2025 the global hygiene components market is worth $26.6 billion, according to Smithers, the global authority on nonwovens markets.

Components in a modern hygiene product include topsheets, backsheets, acquisition/distribution layers (ADLs), absorbent cores, films, wraps, leg gathers, waist bands and stretch ears. Consumption of these will increase at a compound annual growth rate (CAGR) of 5.9% to reach $35.4 billion in 2030, at constant pricing.

Across the same period volume consumption will grow from 6.6 million metric tons in 2025, to 8.1 million tons in 2030, equivalent to a 4.1% CAGR.

Based on primary research and expert market analysis,

The Future of Hygiene Components to 2030 quantifies the market by value and volume; segmented by material, end-use, and geographic region, with five-year forecasts to 2030.

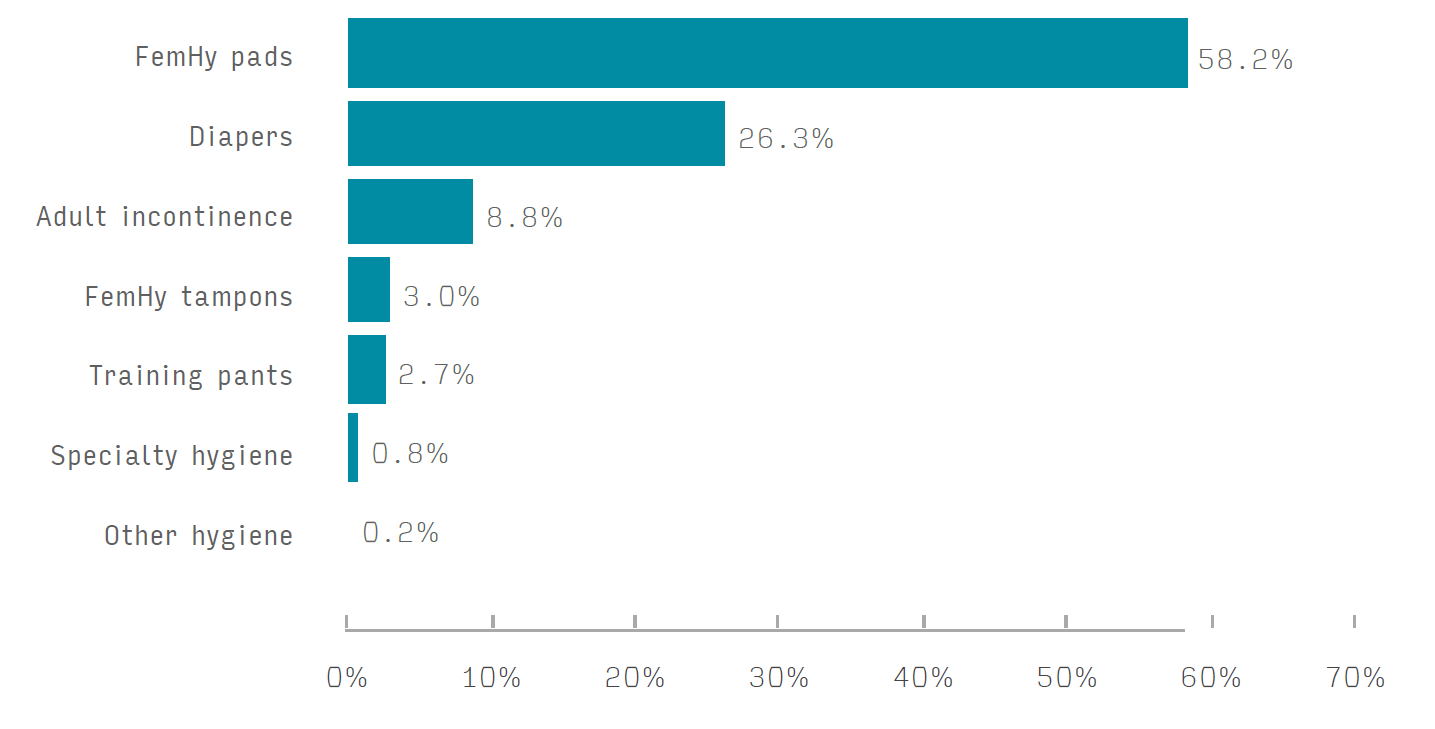

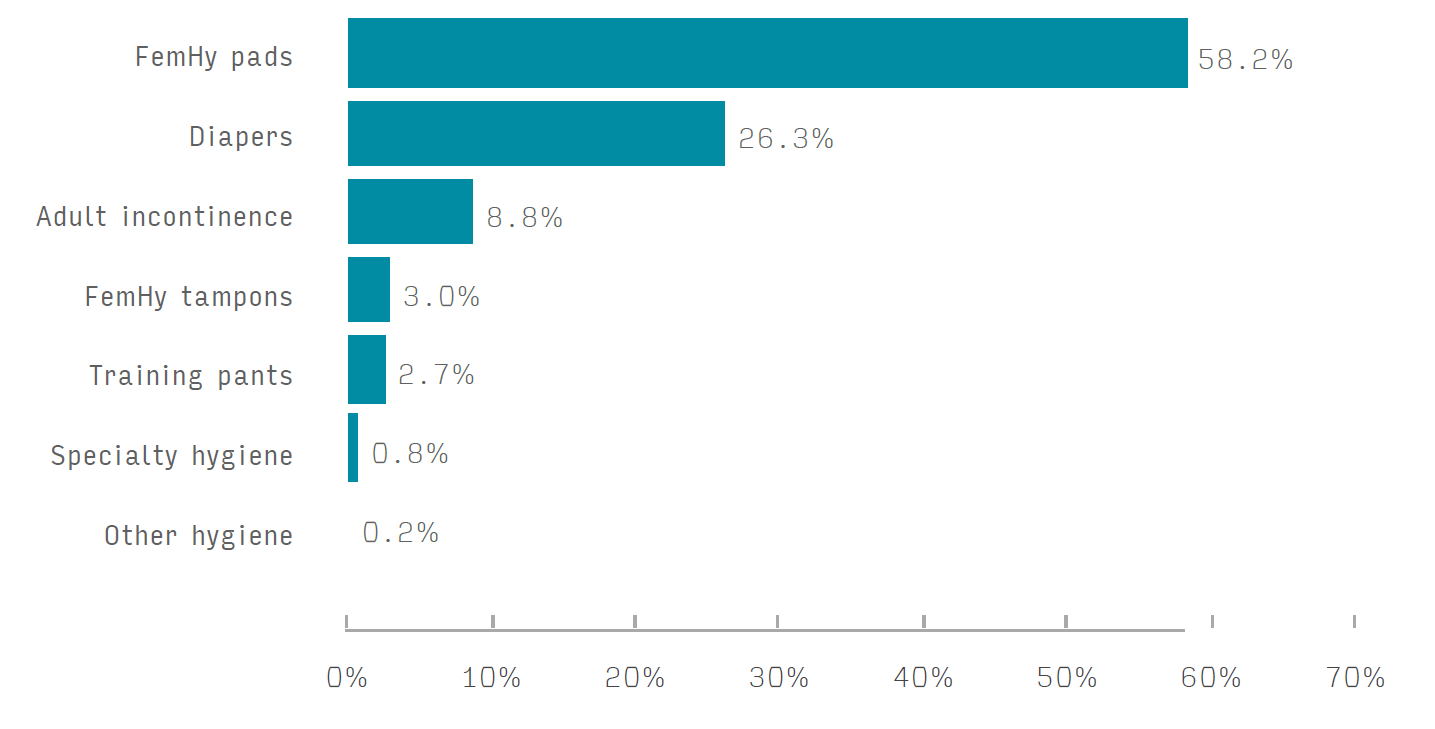

In 2025, a total of 718.3 billion hygiene products – diapers, adult incontinence wear, and feminine hygiene pads – will be sold worldwide, with a retail value of $201.9 billion.

Demand for hygiene products is driven by demographics, and in developing markets by consumer disposable income. In 2025, consumers globally are reacting to recessionary pressures and a decline in purchasing power, which will slow penetration into some growth markets – notably China and India – in the short term, although the longer term outlook for both countries remains strong.

The most lucrative segment of the market is diapers, supplemented by a smaller but faster growing sub-segment of toddler training pants. Together these account for 47.7% of global demand, by value, in 2025. Feminine hygiene sales take up 30.3% of the total market for hygiene products in 2025, with sales remaining solid over the next five years.

The fastest growing segment of the market is adult incontinence wear. In contrast to other hygiene goods, this is not a highly price-sensitive segment. More affluent customers will pay more for innovative components that enable newer, lighter, more aesthetically pleasing, and better performing designs.

Across most hygiene formats there is emerging interest in products without fragrances, parabens, or other chemicals, and more sustainable hygiene components. Wider adoption beyond niche brands will remain limited however, because of cost and performance issues. Sales growth will be powered by the mass-market, and concentrated on less developed regions, taking advantage of a current oversupply of polymer-based nonwovens that will keep input costs depressed.

Fig. 1: Global hygiene components market by end use, 2025 (units)

Source: Smithers

Source: Smithers

The new Smithers market report

The Future of Hygiene Components to 2030, analyses the key market drivers and technical factors affecting future demand for components and finished hygiene goods globally.

It is available to purchase now, priced $6,750 (€6,350, £5,475).